2023 – Is it Time to Map Your Path to Financial Control?

Image by Gordon Johnson from Pixabay

Image by Gordon Johnson from Pixabay

According to the latest statistics from the Money & Pensions Service, most of us would benefit from using a “Sat Nav”, to help plan our journey toward financial peace of mind.

“63% of us don’t feel in control of our lives when it comes to money”

“81% of people avoid discussing their finances”

According to the survey, almost two-thirds of the UK adult population would be more adept at planning their annual vacation than their mid to long-term financial future. 81% of us would simply avoid talking about money matters altogether.

Why do we shy away from understanding such an important aspect of our lives?

Perhaps it’s because we weren’t granted an opportunity to learn about finance other than through fear-inducing maths lessons. Even if quite nimble at mental arithmetic, the algebraic equations, sine, cosine, and slice of Pi could quickly deter students from taking an interest in financial topics. What was not offered in these lessons, certainly at my school, was a practical explanation of life as an adult. How useful would it have been to learn about budgeting, renting a flat, paying bills, buying a car and negotiating deals, insurance, buying a house, saving, investing and arranging a pension?

The truth is, regardless of our education we ALL need to “*Try Harder” when it comes to financial planning, especially when we look at the current economy, a recession that’s forecast for at least the next 18 months and inflation hitting us hard in the pocket. Now is an ideal time for us and those we care for, such as elderly parents, to be better organised with money matters for short and long-term financial peace of mind. (*a flashback to school reports)

Short-Term Manoeuvres

- Review banking arrangements. Ensure Savings are in a high-interest-earning account.

- You may wish to consider whether it is appropriate to consolidate debt such as credit card balances, and loans by having one single debt which carries the most favourable terms

- Review your household spending:

- Mortgage payments. With rates rising check to see where you are with the current terms, talk to your provider and benchmark against competitors.

- Grocery budget. Consider changing to a more cost-effective chain or lower-cost brand options.

- TV/ Music Subscriptions. Re-negotiate deals IF you intend to retain the service. Consider ending or reducing little-used. subscriptions. If within 2 to 3 months of renewal most providers will engage in a negotiation.

- Broadband – Benchmark against competitors and re-negotiate.

- Utility Providers. There’s a great deal of angst with gas and electricity provision. Review against competitors and prioritise those ranked highly for service and competitively priced, (note standing charges).

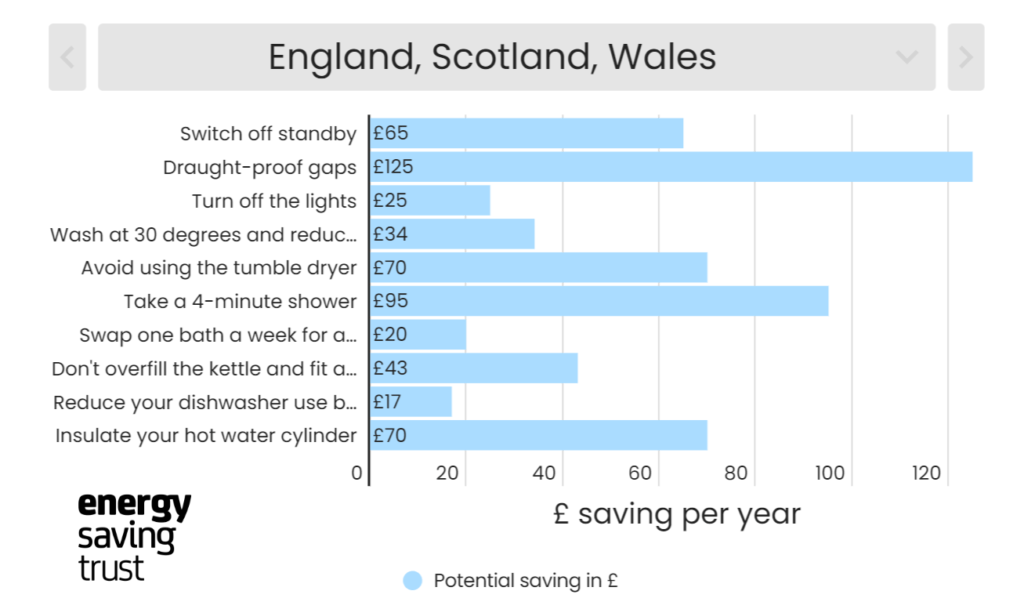

- Heating/ Energy. https://energysavingtrust.org.uk/hub/quick-tips-to-save-energy/

- Considering fuel costs and tax is it time to purchase a more economical vehicle?

- Are you paying for a service you’re not using, Gym, magazine, newspaper, club, or society? Spending on high fashion and expensive brands that may have an economical Might be time to review and cull those that are no longer active.

- Tax – are you taking all your costs into consideration? Worth looking at areas that may help offset tax liabilities such as using part of your home for work.

The Long-Term Destination

Sharpening focus on domestic budgeting can help build confidence in managing your finances but to determine your ultimate destination and long-term plans, it can be hugely beneficial to talk to a qualified financial planning practitioner.

“47% do not feel confident making decisions about financial service offerings”

“55% of working adults do not feel that they understand enough about pensions to make effective decisions concerning adequate saving for retirement”

With half of us nervous about committing to external support with money-related matters it suggests we’re either making poor or no decisions at all!

Far too few of us take an active interest in the ultimate destination in our financial journey through life. Retirement can seem like a distant event, one that will one day result in a magical arrival at your desired journey end, furnishing you with the continuation of the lifestyle you’ve become accustomed to.

With no financial “Sat Nav” tracking and mapping your journey and relying solely on instinct and what you see immediately ahead of you, this desired outcome may prove somewhat illusive and ultimately unrealistic. At the risk of stating the obvious, the sooner you determine what that financial goal is to be the better your chances of arriving in one piece and precisely where you planned to be. The good news is that it’s never too late to make a difference and realign that sense of direction by talking to a professional who can provide directions and put you firmly back in the driving seat.

With the arrival of a new year, it might just be the time to remove mental blocks or yourself from any head-sized holes in the sand. We’re all guilty of “putting off” but once you overcome that reticence, take proactive steps, and have greater control of your finances you’ll no longer risk getting lost on that journey.

If you would like to discuss any aspect of the topics covered in the article above, please contact: Stuart Doughty, Director, Mogers Drewett Financial Planning or complete the call-back form below.